apparently preventing fraud is “anti-crypto”.

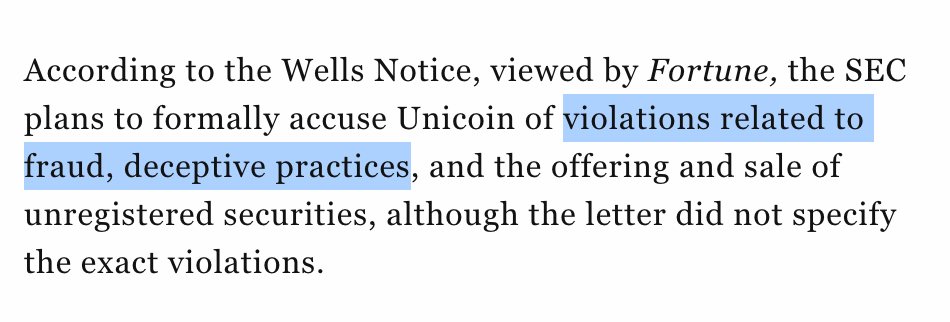

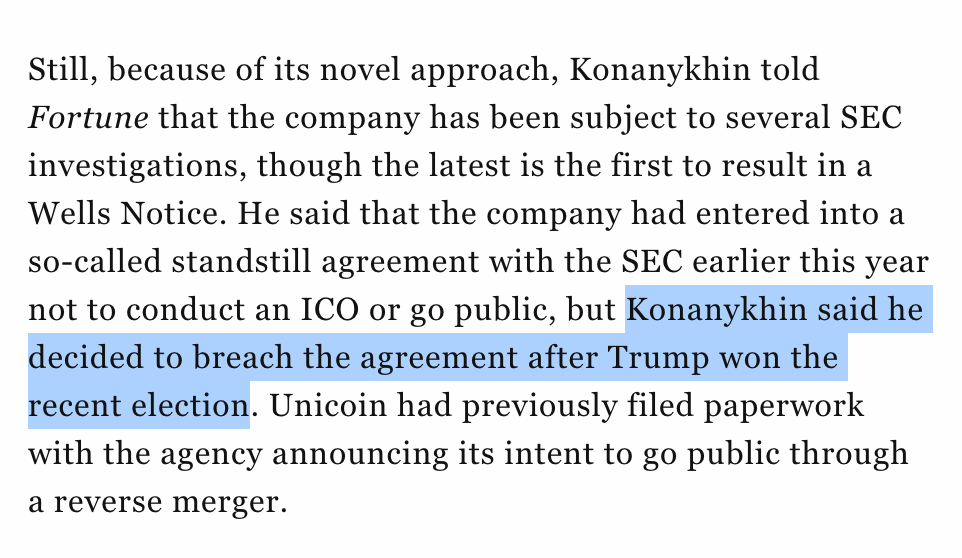

according to this Fortune headline, the SEC going after fraud and deceptive business practices after a company publicly announced they were going to breach a previous agreement with the agency is an “anti-crypto campaign”

This is particularly hilarious given that Fortune has skewered Gary Gensler for failing to go after the FTX, Celsius, and Terra frauds.

Schrödinger’s regulator can’t go after fraud before the company collapses, but if it collapses and the SEC didn’t warn us, they failed.