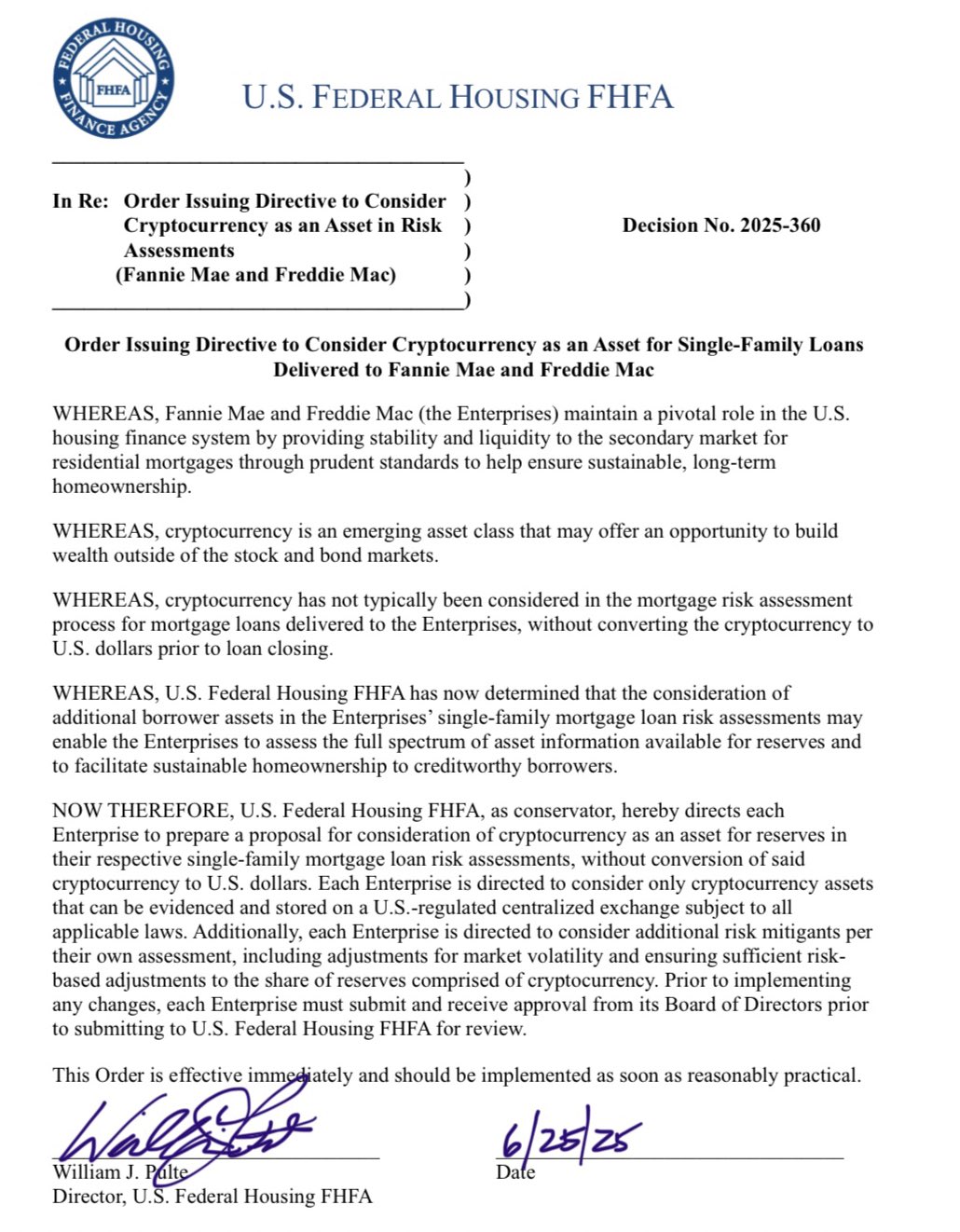

Federal Housing Finance Agency Director William Pulte: “After significant studying, and in keeping with President Trump’s vision to make the United States the crypto capital of the world, today I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage”

Notably, at this point they are merely directed to “prepare a proposal for consideration”.

Also notable: “Each Enterprise is directed to consider only cryptocurrency assets that can be evidenced and stored on a U.S.-regulated centralized exchange”.